Quadrupling Your Money on Lebron James’ Sneakers

Prior to seeing someone having their old sneakers appraised on an episode of the hit TV show Pawn Stars, I had no idea tha:

a.) old sneakers could be worth hundreds (or even $1000+)

and….

b.) some people buy sneakers with the intent of storing or collecting them, rather than wearing them (they call these “Dead Stock” or “DS”).

What piqued my curiosity even further was hearing about that there was a sneaker pawn shop in New York offering people loans secured by their shoes.

The reality is that the resale sneaker market is extremely large. In 2014, over $300 million in collectible sneakers were sold on eBay. I would guess that when you throw in all the private person-to-person sales, many facilitated online via Instagram, the market could be over $1 billion.

Flipping Sneakers vs. Buy-and-Hold

There are basically two ways to make money on sneakers. The first way is flipping (and this is how most money is made).

This strategy is similar to buying stock in a very popular IPO where demand far outweighs supply. If you are lucky enough to be able to buy the stock at the offering price (because you are a good customer of the investment bank doing the offering, or for some other reason), you may be able to turn around and sell the stock at a much higher price once the market opens and the stock is available to all customers.

Manufacturers like Nike and Adidas keep supply below demand when certain sneakers are released.

What ends up happening is that there are far more people trying to buy the shoes in store and online than there are shoes to sell them.

Huge lines will form hours or days before a shoes is released; people (or bots) will constantly refresh the website screen in attempt to be ready to purchase the minute a new shoe comes available.

So someone that was lucky enough to buy the Jordan 1 Retro Chicago at the $160 suggested retail price when it was released in May of 2015 could have possibly immediately re-sold it on online marketplaces like eBay, Flight Club, or Goat for around $400.

Obviously the more you bought, the more money you could make. Even though companies like Nike are leaving money on the table by not selling the their shoes at a higher price initially, there are also advantages to doing this. It drives fanatical interest in their new releases, avoids them being considered a price gouger, encourages people to collect their shoes, etc.

Buying and Holding

The second way to make money is by speculating — buying and holding sneakers — for years.

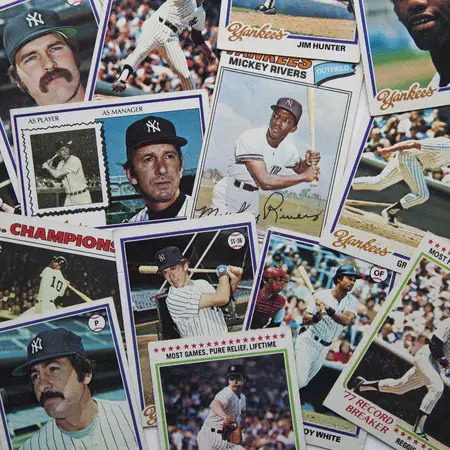

Like a lot of other collectibles (art, baseball cards, etc.), it is possible the value of the shoes could increase (or decrease) over time.

While sneakers don’t pay interest or dividends like a bank account or shares of a stock might, many people do look at them as a piece of art and something to be displayed and enjoyed.

For collectors, the Kelley Blue Book of sneakers is StockX. They track the value and volume of sneakers selling on eBay. As an example, if you were able to buy the Nike Lebron 7 Christ the King (CTK) sneakers when they were released in April 2010 for the $140 retail price, they could be sold in DS condition today for an average of $525 (almost 4x).

Things to Consider

A lot of these shoes don’t appreciate in any kind of straight line fashion, so it is quite possible that a particular shoe could have yielded a better price if you just flipped it immediately.

There are events that could cause a shoe to appreciate; maybe if the celebrity namesake were to win the NBA Finals a couple times or were to switch from Nike to Adidas, or maybe the supply just decreases over time with fewer people willing to put them up for sale.

This is highly speculative though and nothing is guaranteed. I have seen some examples of particular sneakers appreciating, however, I haven’t seen data that demonstrates the appreciation rates over time and how this compares with the initial profits you could earn right after the time of release.