Mass Mailing Offers to Land Owners

Rural Land Buying is a Small Niche Market

Buying and selling rural land is not a popular investment strategy; in fact, it is a very narrow niche that few people know about. However, for those that are aware of it and competent at doing it, it can be a moneymaker with double digit percent returns. The idea is to buy land cheaply that someone no longer wants (or stopped paying property taxes on), then put some nice marketing around it, and sell it to a buyer for a higher price — typically by carrying the financing. So let’s say you buy an acre out in the country for $2000 and then mark it up to $5000 and re-sell it. Instead of paying for it upfront in cash, they pay you over 60 monthly payments. This makes the monthly payment quite manageable. This strategy is not unlike what a car dealer is doing, with a few key differences:

1.) The margin is generally much higher for land. A car dealer can’t buy a $10,000 wholesale car and sell it for $20,000 retail; but that type of spread could be achieved on land.

2.) A car dealer has the ability to move a lot more volume. Cars are very liquid while the number of people looking to buy rural land is smaller. It might take months or even years to re-sell a piece of land.

3.) Car dealers generally have a bank or credit union that finances the purchases. With land, owner carryback financing means you (the seller) are the bank. You are the one receiving the payments. While you might be able to sell the loan if it is big enough and is “seasoned” (received several payments), you will generally need to sell it a moderately large discount to face value. Because of this, most land sellers just hold the note for the duration.

Where Can You Buy Cheap Land?

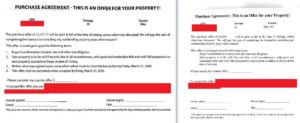

Where do you get this land that you can later mark-up and flip? One of the most popular ways is buying at a county tax sale. You typically have a large volume of land for sale and a ready and willing seller who will sell each parcel that day to the highest bidder. Another way to do it is to mass mail offers to land owners. You make an offer, sight unseen on hundreds or thousands of properties based on what you think they each are worth, then mail the offers to the property owners. They can respond with a signed acceptance or can contact you with a counter offer. Either way, you leave yourself a short due diligence period primarily to make sure the owner who accepted the offer really holds an unencumbered title to the property (you could also back out for other reasons if you had to). Here is an example of two of those offers received on the same 10 acre piece of land in Elko County, Nevada. You’ll note that one offer was for $1417.77 and another offer was for $2099:

How many of these get accepted? Response rates for direct mail in general are typically less than 2%. Something like an unsolicited offer for land is going to have an even lower response rate. One service that handles direct mail for land buyers called Offers 2 Owners, lists these numbers for the January 2019 offers they sent: 372,455 offers mailed and 917 properties purchased. That works out to 0.25%. If the cost of one letter is $1, that ratio would get you 2.5 property purchase opportunities per $1000. This is one source who disclosed the data for one month. It’s possible you could send 1000 letters and get zero purchase opportunities. It’s something you want to control and monitor closely, and not just the format of your letters and how much are you offering, but whether postal mail continues to be a viable means of communication.

How Much Can You Make?

That’s an impossible question to answer. It comes down to what you are buying, how much you are able to mark it up and sell it for, and whether your direct mail program is effective in finding you land purchase opportunities. There are many people that have made a business of buying and selling rural land, and there are plenty of others that have bought a few parcels, then given up when they realize it was either not profitable or the profit per deal was too small to justify the amount of time and effort they put into it.