What Should You Buy Now If You Think Hyperinflation is Coming Soon?

It Could Happen Again

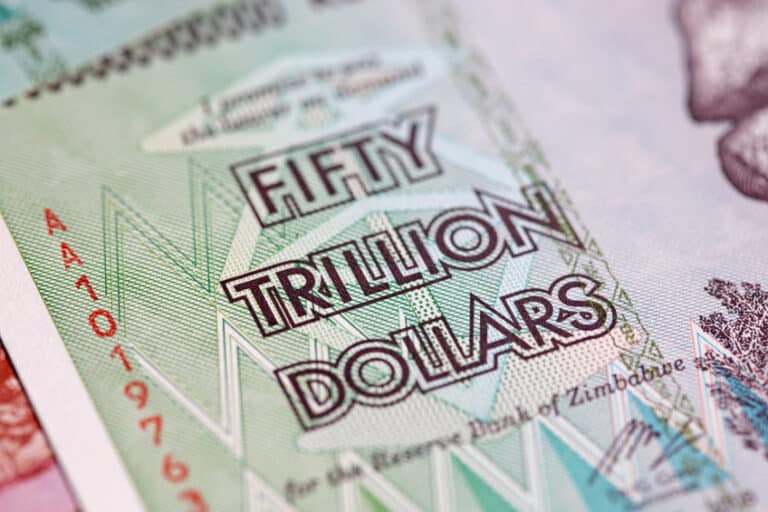

Hyperinflation has happened numerous times in history: Weimar Germany (1922), Hungary (1945), Zimbabwe (2007), Yugoslavia (1992), to name a few. Venezuela under tyrant Maduro is a recent example, starting in 2016.

When a government recklessly spends far more money than it brings in, it has to borrow the money to make up the difference. If no one will loan the country the money, the country just prints up more money to pay its bills and debts. The more it prints, the more worthless the existing currency becomes.

If it gets bad enough, the value of the currency might be cut in half in a few days or even a few hours. The minute that people get paid, they immediately try to spend all their money as quickly as possible. Because a gallon of milk might cost $5 today, but might cost $10 tomorrow, then $20 the next day, $40 the day after that, $80 the day after that, $160, $320, $640, $1280, etc.

And that assumes a predictable straight line inflation rate. Many times the inflation rate goes exponential and in many cases, producers simply stop producing the products because the economy stops functioning properly or the government implements price controls or other measures.

We are Seeing Signs of Inflation

The United States has gone from very little inflation to an elevated level of inflation in only a short period of time. Official inflation statistics don’t yet reflect some of the drastic double-digit increases in the prices of things like houses, lumber, used cars, groceries, gasoline, steel, kitchen appliances, and medicines.

Additionally, after Joe Biden was elected president, the tone in Washington has changed to the point that it doesn’t seem like anyone cares about running up gargantuan deficits anymore. Multiple rounds of coronavirus relief have passed, even after the coronavirus’s effect on the economy seems to have largely passed. People are being paid the equivalent of about $25 per hour per person to not work, even though there are multiple industries that are absolutely desperate for workers.

Entitlement reform of existing entitlement programs like Social Security, Medicare, Medicaid or Obamacare is politically impossible, and new massive entitlement programs are being proposed in areas like voiding college debt, free community college, universal basic income, and free child care, to name a few.

So if early indicators of inflation, coupled with an obviously irresponsible government have you convinced that hyperinflation is right around the corner, what do you buy now in order to protect yourself?

In Hyperinflation, You Choose the Least Bad Option

The first thing to realize is that you are probably going to be worse off no matter what. Many of your unprepared fellow citizens will be much worse off; some will starve to death. The economy will have all sorts of problems and will cease functioning in certain areas.

If you thought the Covid run on toilet paper at the supermarket was bad, get ready because the shortage of virtually everything will get really, really bad. Suppliers will stop supplying anything in many areas of the economy because government price controls will mean you can’t make a profit or even break even. People will stop showing up for work when their pay is worthless by the time they receive it.

Also, when people are starving the death, expect an increase in crime.

Finally, no matter what you buy, you should have a current valid unexpired passport that doesn’t expire in the next year. There may come a point where waiting it out for things to get better no longer makes sense.

With that being said, here are the things you should buy now if you think hyperinflation is coming soon:

1.) A House with a 30 or 15 Year Fixed Rate Mortgage, or an Adjustable Rate that Does Not Adjust for Many Years in the Future – if you own a house with a long term fixed rate mortgage, not only will you avoid dramatic monthly rent increases, you will benefit from the fact that your lender will have the value of the mortgage essentially wiped out in a short period of time. If you owe $500,000 and your monthly payment is $3000, it might be only a matter of days before the monthly payment is equivalent to the cost of a gallon of milk and a matter of weeks before the total principal balance is also worth just a gallon of milk. So after a tiny payment, you’d own your house free and clear.

2.) Foreign Currency – how many Americans do you know that have a foreign bank account in a foreign currency? I can think of part-time US residents that also have a home in Canada, US expats living in another country, but that’s about it. If you have money in a foreign currency in a foreign bank, that currency won’t necessarily become hyperinflated. Also, the US bank won’t have control over the foreign bank so it will be harder for them to force you to current your foreign currency into worthless US currency in a hyperinflation scenario. In places like Zimbabwe that have experienced hyperinflation, people simply stopped doing any business in Zimbabwe dollars and started doing business in Euros, US Dollars, South African Rands, etc. You will have a functioning debit card and valuable money in order to survive the hyperinflationary period. Obviously you have to pick the right currency to park wealth in and that country’s banking system has to be receptive to allowing US citizens to have accounts.

3.) Gasoline and Propane – think about the awful Jimmy Carter years. You want to have the ability to operate a motor vehicle and cook for as long as possible, not be waiting for hours in a long line at a gas station, hoping and praying that there will be some left by the time it’s your turn. If you have the ability to have an underground or above ground tank for gas, you could buy thousands of gallons for future use. Propane doesn’t expire so you could stockpile dozens of tanks for cooking on your grill.

4.) Solar Panels and a Well for Water – in addition to having gas to run your car or heat your home, you can pre-buy your future electricity and water needs by spending money up front to buy solar panels and to dig a well for water if that is an option.

5.) Personal Hygiene Items and Cleaning Items – things that you use and your family uses on a regular basis like brand name shampoo, soap, toothpaste, deodorant, dental floss, tampons, Q-tips, Clorox wipes, all-purpose cleaner, baking soda, etc. You should stick to brand name products rather than generic. The reason being is that if no one will accept a nation’s currency, people are likely to barter brand name products almost like a currency. It’s like you see in the movies where people in prison or a prison camp barter for various purchases with packs of cigarettes.

6.) Non-Perishable Food – ideally you would go into the hyperinflation with a couple of years worth of non-perishable food for your family to eat, even if you have a hard time buying more food. The average Venezuelan in the most recent hyperinflation lost over 17 pounds in 2016 and many starved to death. Think about canned meats, canned soups, coffee, tea bags, cereal, protein and granola bars, dried fruits, dried noodles, and multivitamins. Wine and whiskey might also be useful for bartering.

7.) Guns and Ammo – not only can you protect yourself with guns and ammo, they are valuable but reasonably light weight stores of value. You can use them to barter for other items that you need. You know what they are worth based on the manufacturer and type of gun. There is a reason pawn shops deal in a lot of guns. They know what they are worth and how much they can reasonably loan against them.

8.) Gold, Silver, and Maybe Bitcoin – gold and silver have functioned almost like currencies for thousands of years and they would likely do so during a hyperinflationary period. The drawback is that you can’t really use them for anything other than as a currency. You have to assume there would be a farmer that would sell you food in exchange for your gold bar. Probably a safe bet but not guaranteed. Assuming bitcoin would function like gold in hyperinflation is a tremendous gamble, but it’s conceivably possible it might. You can convert it into multiple currencies at least right now so if, for instance, Swedish krona held their value but the US dollar became worthless, you could convert to the better currency. Again this is tremendous gamble. It’s quite possible cryptocurrency is just a theoretical construct and is itself worthless.

9.) Cars – cars have a lot of utility value in getting you around, moving supplies, etc. and are easy to price. You can look up a brand name car of a particular year and mileage and get a Kelley Blue Book value to reach an accurate estimate of its value. As such, a car is like a rolling bank account in that it can be traded for money upon demand. That being said, it obviously depreciates over time but at an exponentially lower rate than currency in a hyperinflationary period. If you don’t have any cars at all, it prevents you from relying on Uber or public transportation which may cease to function in hyperinflation.

10.) Forever Stamps – you may not need to mail many items during hyperinflation, but as long as the government stands by its promise to make the value of a Forever stamp equivalent to the cost to mail one regular envelope, you have a tangible store of value that should precisely index inflation. As such, you could use stamp books like a currency. Maybe one stamp book would be worth a gallon of milk.

11.) Nickels – it is currently illegal to melt down a 5¢ nickel in order to extract the copper and nickel content out of it. But if you could, the amount of nickel and copper in many nickels is actually worth $0.05 or more. So if the law were changed or effectively eliminated during hyperinflation, bags of nickels would continue to be worth something even though the currency they represented was worthless.